- An independent regulatory agency, we oversee vital components of the secondary mortgage market including Fannie Mae, Freddie Mac and the Federal Home Loan Banks: 66789: html: True: aspx: Government: 153: text/html; charset=utf-8 Article Page: 8/2/2018 7:39:31 PM.

- The Freddie Mac Exclusionary List is confidential, and only accessible by Freddie Mac and Mortgage Lenders – there is no data list we are aware of that shows the public in general who is on the List.

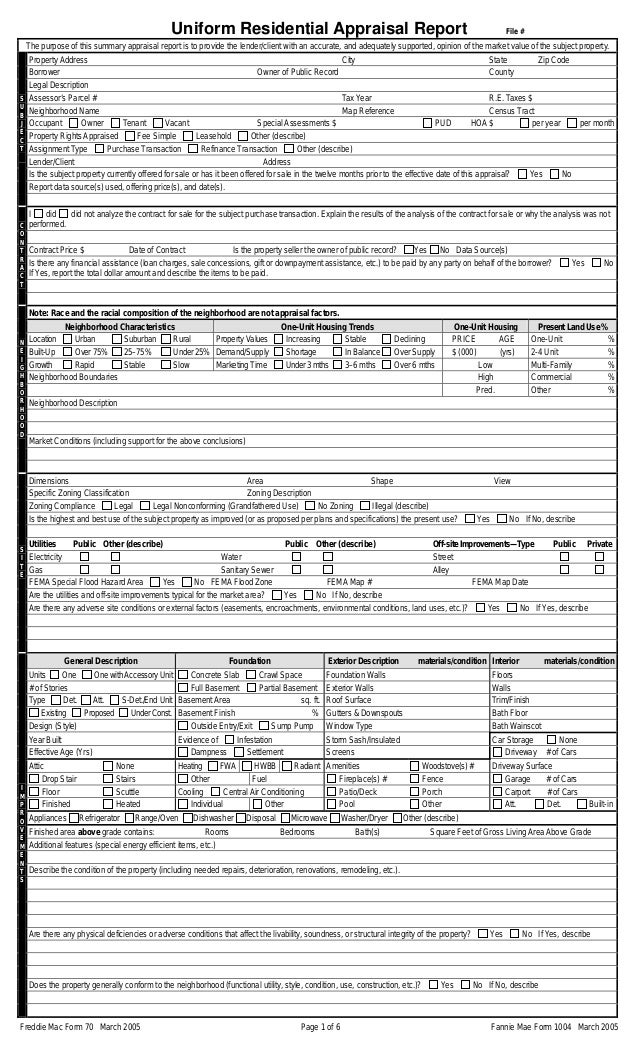

- Uniform Instruments Freddie Mac and Fannie Mae/Freddie Mac Notes, Riders, Security Instruments, and other documents. Exhibits Exhibits referenced as part of the Guide unless otherwise indicated. AllRegs The Guide on AllRegs is the official electronic version of the Single-Family Seller/Servicer Guide.

Few people understand the Freddie Mac List, what it means to be on that List, and how to come off the List.In the time we’ve been representing clients to come off the List we’ve come across some myths and misconceptions, so we want to dispel some of those:

Being on the Freddie Mac Exclusionary List means I’ve Committed a Crime.

While it is true that there is some criminal conduct that will cause you to be included on the Exclusionary List, being on the List itself is not a crime.Inclusion on the List simply means Freddie Mac (Federal Home Loan Mortgage Corp or FHLMC) believes you did something, or multiple somethings, that hurt the integrity of the loan product backed by Freddie Mac – you created non-investment quality loans.In some cases, we’ve seen Freddie Mac report the conduct to the state or federal licensing board and in other cases, we’ve seen Freddie Mac report the conduct to the Federal Bureau of Investigation (FBI).However, to answer the myth above, it was the conduct that caused you to go on the List that could be criminal, but being on the List itself is not criminal.

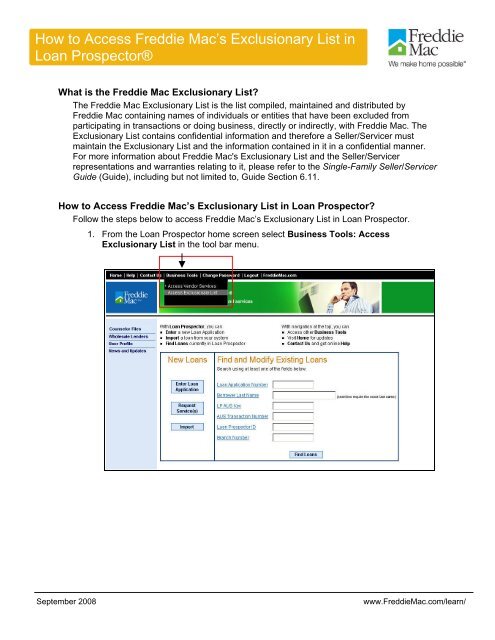

Please click the Hours of Operation link above to review a complete list of Customer Support Contact Center (800-FREDDIE) and other Freddie Mac technology systems hours of operation. Create/view certification forms, view settlement statements, search for loans, search for contracts, and designate a warehouse lender. Exclusionary List – This role can view the Freddie Mac Exclusionary List. Loan Manager – This role can create and modify a loan. Members of this group can create loans in Loan Selling Advisor.

Freddie Mac Shares my Information with Other Lenders

The Freddie Mac Exclusionary List is confidential, and only accessible by Freddie Mac and Mortgage Lenders – there is no data list we are aware of that shows the public in general who is on the List.However, in some cases, loan originators and mortgage brokers will check the List in the course of a Freddie Mac closing, see that someone is on the List, and exclude that person from participating in other transactions with that origination company.Freddie Mac does not share the List, but loan originators may make independent decisions to exclude people on the List from doing business with them.

The List Will Expire at Some Point

Unfortunately, we know of no statute of limitations in connection with the Exclusionary List. Once you’re on the List, you’re on the List until Freddie Mac agrees to take you off the List. Theoretically, you could be on the List forever.

Freddie Mac Excluded me without Due Process

If there were any type of cause of action that could be filed against Freddie Mac, it would possibly be the inclusion of people on the List without due process.Unfortunately, in every case we’ve seen, Freddie Mac has given the person on the List the opportunity to explain their actions and describe why they should not be on the List. Typically, the person about to go on the List gets a letter from Freddie Mac about 30 days before they go on the Exclusionary List, with an opportunity to explain the reasons why Freddie Mac should keep them off the List. Thus, there is some due process as they are giving a chance to explain and defend themselves.Interestingly, however, we’ve never seen someone get that initial letter and thereafter not go on the List. In every case that Freddie has issued a letter, in our experience, the accused has ended up on the List.In some cases, the person has moved and the letter is sent to an old address, or the person might ignore the letter until they’re preparing for a closing only to get that awkward call, “we saw your name on the Freddie Mac Exclusionary List, and we have some bad news …” Therefore, they get due process in receipt of the letter, if they’re at the same address and they open and read the letter, but they typically never are able to convince Freddie to keep them off the List.

Being on the Exclusionary List means I Can’t do any Closings

The purpose of the List is to exclude real estate professionals from participating in real estate transactions where Freddie Mac is a party; it is not to exclude real estate professionals from participating in any real estate closing.Someone on the List could participate in a cash deal (no financing), or they could participate in a transaction where the lending is being provided by the US Department of Veterans Affairs (VA), a conventional loan, a private loan, or even a Fannie Mae loan.Further, the mortgage originator could fail to check the Freddie Mac Exclusionary List and let someone slip through the cracks and participate in a closing.I have a suspicion, however, that if that happened too many times, that originator would find themselves on the List. Being on the List does not mean that you cannot participate in a closing, only a Freddie Mac closing.

For more information on the Federal Home Loan Mortgage Corporation (FHLMC) (Freddie Mac) Exclusionary List, please contact us to schedule a free initial consultation to discuss your options at 727-261-0224' target='_blank'>727-261-0224 or email me directly at shawn@yesnerlaw.com. Please also subscribe to the Crushing Debt Podcast, on Apple Podcasts, Spotify, and other podcast players, including Amazon Echo (“Alexa”) for more free information about these topics.

Shawn M. Yesner, Esq., is the host of the Crushing Debt Podcast and founder of Yesner Law, P.L., a Tampa-based boutique real estate and consumer law firm that helps clients eliminate the financial bullies in their lives. We assist clients with asset protection, the sale and purchase of real property, Chapter 7 liquidation, Chapter 13 reorganization, bankruptcy, foreclosure defense, debt settlement, landlord/tenant issues, short sales, and loan modifications in Tampa, Westchase, Odessa, Oldsmar, Palm Harbor, Clearwater, Pinellas Park, Largo, St. Petersburg, and throughout the greater Tampa Bay area.

This article is a direct re-post from the Freddie Mac website and can be found by clicking here. Congratulations to the eagle-eyed investigator who uncovered the mortgage fraud.

Falsified College Transcripts Flunk 13 Loans

When you graduated from college, it’s likely you couldn’t buy a home faster than you could frame your diploma.

That’s why it seemed suspicious to one of our Sellers when two mortgages originated by the same loan officer had almost identical borrower profiles. Both borrowers claimed to be recent college graduates, had limited work histories, had the same job with the same employer and had been qualified for a home loan in northern California. The Seller reported these concerns to Freddie Mac.

13 Suspicious Loans − One Originator

Once the Seller’s report came in, our fraud investigator began digging into the case.

She started by running an exposure check on the loan officer at the company that originated the loans. She ran a report to identify loans sold to Freddie Mac that were associated with the loan officer’s Nationwide Mortgage Licensing System (NMLS) identification number.

The investigator then looked for similarities and patterns across those loans, including in the loan applications and other documents. In addition to the two loans reported by the Seller, she discovered another 11 loans where the borrowers claimed to be recent college graduates. The same loan officer originated a total of 13 such loans. Each loan had different borrowers; some had one borrower and others had a borrower and co-borrower.

The borrowers’ employment documentation was limited to only a couple paystubs and did not include W-2s or tax returns, each claimed to work at one of just two companies and stated that they attended public colleges or universities in California or Washington. Our investigator contacted each institution to verify whether the borrowers had recently graduated. In every instance, the schools had no record of them.

Prior Conviction

Additionally, the investigator searched certain databases and learned that the loan processor’s California real estate license had been revoked years earlier due to a prior conviction for, among other things, wire fraud conspiracy. The loan processor was not licensed in California when the loans in this case were originated.

Lack of Controls

When our investigator visited the company that originated the loans, she discovered the office had been shuttered and the only remaining employee was the broker. “There were still flyers in the windows promoting properties for sale, but the office had clearly been closed for some time,” she says.

The broker stated that he wasn’t aware of any of the falsified documents in the loan files and didn’t know that the loan processor had a criminal record. While the broker claimed that the company had some controls in place to supervise loan origination, the proper controls ultimately weren’t in place to prevent the fraud from occurring.

Falsified College Transcripts on the Rise

Since she investigated this case, our investigator has seen several other cases involving falsified employment. In some of those cases, false college transcripts have also been a factor. “We’re seeing an increase in false claims of higher education,” says the investigator.

She adds that underwriters often don’t think they can contact a college or university to verify attendance and/or graduation dates. It’s a simple step toward confirming that a borrower truly graduated. If the institution has a policy against sharing this information, it will let you know. “The schools I contacted in this case were willing to verify attendance,” our investigator says.

“If a borrower is dishonest about their education on their loan documentation, that’s a big red flag,” adds our investigator.

Freddie Mac Exclusionary List Lookup Information

Suspect Fraud?

Freddie Mac views matters of fraud very seriously, and takes appropriate protective measures that may include, without limitation, placing the names of individuals or entities on our Exclusionary List, or E List.

Freddie Mac Appraiser Exclusionary List

If you spot or suspect fraud, let us know by contacting the Freddie Mac Fraud Hotline at 800-4FRAUD8.